A metal Charles Schwab Bank Visa ® Platinum Debit Card emerges from the gray side into the blue side. Narrator: To use Zelle, you'll first need a Schwab Bank High Yield Investor Checking account…Ī circled checkmark appears above the text. Schwab Bank High Yield Investor Checking ® account The columns all disappear, replaced by a background split into two colors-the left side blue, the right side gray. Narrator: In a few clicks, you can pay a babysitter, reimburse a friend for dinner, or split the cost of a family vacation. An airplane takes off between the two suitcases, leaving behind another dollar sign. The purple column then expands into the whole screen, and another sticker-covered suitcase rolls into frame. The pizza slices pull apart from each other, all surrounding a dollar sign. A baby stroller rolls into the gray column a pizza cut into slices appears in the blue column and a rolling suitcase covered in travel stickers rolls into the purple column. The tablet disappears, replaced by the three columns. Just remember to only send money to someone you trust. Narrator: You can send money to almost anyone who has a bank account in the U.S. A tablet arises and shows the Schwab logo and the words "Own your tomorrow ®." The logo then gets replaced by the login screen for the Schwab Mobile app, and Face ID pops up and verifies that this is the correct person logging in. The blue column expands and pushes the other two columns off the screen. Narrator : When you need a fast and safe way to send money to friends or family, it's easy with Zelle in the Schwab Mobile app. In the gray column, a stopwatch icon appears above the word "Fast" in the blue column, a padlock appears above the word "Safe" and in the purple column, a smiley face appears above the word "Easy." The logos then give way to three columns: one gray, one blue, and one purple.

The Charles Schwab Bank and Zelle ® logos appear side by side.

Zelle quickpay limit plus#

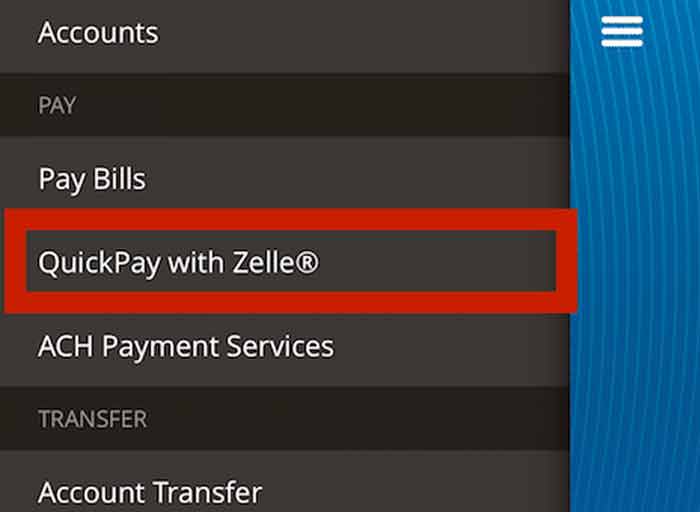

“By connecting with an additional dozen plus financial institutions, we expect more people will want to pay the dog walker or share the dinner bill seamlessly using QuickPay with Zelle,” added Wallace. Funds sent via Chase QuickPay with Zelle are typically available within minutes. QuickPay with Zelle allows payments to be sent and received with each other by simply using the recipient’s mobile phone number or email address. “Consumers want a safe and fast way to make payments and Chase QuickPay with Zelle offers them the ability to pay each other in a simple and consistent way.”Ĭhase customers sent more than $28 billion person-to-person transactions through Chase QuickPay in 2016, representing 38% growth over 2015. “A growing number of customers are choosing Chase because they like our online and mobile capabilities,” said Bill Wallace, Head of Chase Digital Banking. In the next few weeks, customers will be able to send and receive money in minutes with about 86 million customers of more than a dozen financial institutions without leaving the security of their bank app. When Chase customers use Chase’s person-to-person payments functionality, they’ll automatically see Chase QuickPay® with Zelle in the Chase Mobile® app and on.

0 kommentar(er)

0 kommentar(er)